Table of contents

Whether you’re a savvy trader already or looking to become one, online brokerage Questrade provides some of the most powerful and user-friendly tools available to Canadian citizens. Browser-based tools, a downloadable desktop platform called IQ Edge, and IQ Mobile are among the analytics and research tools advantages to clients.

For those who prefer even more simplicity, Questrade offers affordable managed services helmed by experienced brokers.

Overall, Questrade compares favorably to other discount brokerages like i-Trade, Virtual Brokers, Interactive Brokers, and Qtrade when it comes to products, fees, and services. During this review, I’ll walk you through the primary tools and costs so you can decide if Questrade the best discount brokerage for you.

About Questrade

Questrade launched in 1999. It’s mission: help ordinary Canadian citizens achieve financial independence. Today, Questrade boasts hundreds of thousands of clients and claims 30,000 new accounts annually. Their success hinges upon advanced tools and low commission costs.

With Questrade, you can either manage your money personally or let a Questrade professional handle your trades and investments. Variable pricing is available in either case, which I’ll cover in the “Prices” section, below.

Questrade supports not only stock buying and selling, but options, ETFs, mutual funds, precious metals, and bonds, too. Trading is accommodated for most North American markets. These include TSX, TSX Venture, NYSE, NASDAQ, AMEX, and ARCA.

Top Services of Questrade

Questrade provides two primary services: self-directed investing and managed investments. Self-directed investing is for those who prefer to handle their money on their own. Managed investing, dubbed “Portfolio IQ,” lets you buy into diversified mutual funds. Let’s look at the basics of what you get with each service.

Questrade Self-Directed Investing

As mentioned, self-directed investing accommodates do-it-yourself traders. As a subscriber, you’ll have access to an online platform suitable for both novice and advanced users. The platform is designed to be all-in-one, so you can research stocks, make trades, and monitor your performance without having to utilize external tools.

Questrade’s primary analytics tool is Intraday Trader, which lets you access pre-defined watch lists or set criteria to receive tailored insights and alerts. You can monitor both U.S. and Canadian equities.

You can also access Questrade Market Intelligence, a research center that includes reports, earnings, and other financial data for both individual companies and market sectors. Stock screeners help you hone in on particular interests.

Other resources include a newsletter called The Daily Ticker, a mutual fund research center, a bonds bulletin, and tools to study FX and CFD markets.

IQ Edge is another flagship Questrade tool: a downloadable desktop platform for both Windows and Mac. It will appeal to advanced traders, with pop-out windows that will let you keep an eye on specific markets and tools for making conditional trades.

Questrade also offers a mobile tool, called IQ Mobile, to help you track stocks while on the move. Native apps are available for iOS and Android.

Questrade.com Portfolio IQ Overview

Portfolio IQ is Questrade’s mutual fund service. Rather than make trades yourself, it lets you put your investments in the hands of a professional. Investments are diversified to limit risk and insured up to ten million dollars.

ETF portfolios are available in multiple industries and regional markets around the world. Accounts are actively managed and adjusted based on market shifts. Dividend income and cash deposits are automatically reinvested to improve compound growth returns.

Learn to Trade Resources

Whether you’re trading on your own or investing in a portfolio, as a Questrade subscriber, you’ll have access to their robust learning platform, “The Exchange.”

The Exchange features regular blog articles from industry professionals. If you prefer watching to reading, you’ll also find plenty of video content. Basic video tutorials will help you learn to use the various Questrade tools. Detailed webinars are designed to improve both your financial acumen and your profits.

At its core, though, the Exchange is a portal designed to help you get in touch with the Questrade user community, talk shop, and share strategies.

Questrade.com Prices

Self-Directed Investing Pricing

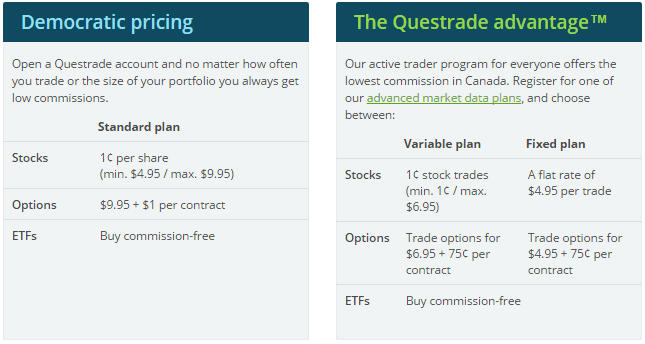

For self-directed investments, Questrade offers two different pricing programs.

The first, called “Democratic Pricing,” is designed for casual traders. Stock trades cost one cent per share. While there is a minimum charge of $4.95 per trade, there’s also a max of $9.95. Under the terms of democratic pricing, options cost $9.95 plus $1 per contract. ETFs are commission free.

The second pricing program, designed for more active traders, is called “Questrade Advantage.” You can opt for either a variable or fixed plan when you sign up for Questrade Advantage.

Under the variable scheme, stock trades cost a minimum of one cent and max of $6.95. Option trades cost $6.95 plus $0.75 per contract, and ETFs commission free.

For fixed-plan subscribers, individual stock trades cost a flat $4.95. Options trades are cheaper than with the variable plan, at $4.95 per trade plus $0.75 per contract. ETFs are still commission free.

Additional fees exist for certain activities. These include a $45 commission for trades completed through the Questrade trade desk, commission charges on orders filled over multiple days, a SEC fee on the sale of U.S. securities, and Exchange and ECN fees.

Questrade.com Portfolio IQ Pricing

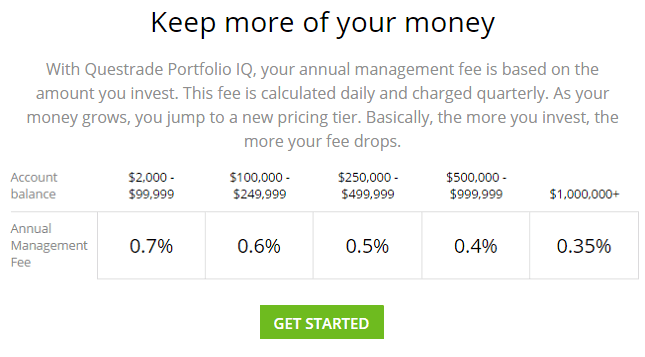

There is an annual fee for managed investments billed quarterly. The percentage of this charge slides based on the amount you invest. The more you spend, the lower the percentage.

You can put in less than $2,000, but in that case, your account gets held in cash (no management fee charged). Your money will not be invested in a portfolio until you pass the $2,000 threshold.

No account, trading, opening, closing, or electronic fund transfer fees get charged to Portfolio IQ investors. However, Questrade does charge certain administrative fees, such as for wire transfers, stop payments, and transferring accounts to other companies.

Here’s a quick look at managed services fees charged by Questrade:

| Service | Fee |

|---|---|

| CAD$ electronic fund transfer (EFT) up to $25,000.00 | Free |

| USD$ electronic fund transfer (EFT) up to $25,000.00 | Free |

| CAD$ wire transfer | $20.00 |

| USD$ wire transfer | $20.00 |

| International wire transfer | $30.00 |

| CAD$ and USD$ uncertified cheque | $40.00 |

| Certified cheque | $50.00 |

| Stop payment | $75.00 |

| NSF cheque/returned items | $25.00 |

| Transfer out an account to another institution | $150.00 |

| Partial transfer of account to another institution | $25.00 |

Criticism of Questrade.com

To get a better idea of how experienced traders perceive Questrade, I surveyed message boards and other reviews. Most of the criticism I discovered conceatrns reports of slow customer support responses to emails, and long telephone hold times. I’ll cover the specifics of available support channels in the next segment. However, it’s worth noting that Questrade also offers online chat, with nearly immediate response times.

Regarding commission rates, costs are lower than most banks and comparable to other discount brokers. The available pricing options and fees can be a bit complicated and confusing for new users, though.

Finally, while ultimately quite powerful, many people seem to find that the Questrade platform is not as intuitive as some competitor platforms. However, with the help of online chat and the many resources available via “The Exchange,” you should get the hang of trading on Questrade pretty quickly.

Customer Support

Questrade offers multiple support channels to help you enjoy a smooth user experience.

The fastest channel is their online chat option. You can live message with a support representative by clicking the “chat” icon available on most website pages. In testing this resource, I found I could get in contact with a support representative within just a few seconds. Online chat is available during weekdays only, from 8 a.m. to 8 p.m. ET.

If you prefer to talk to a live person, you can call Questrade support. Hold times can be long, though, so it’s probably better to take advantage of their call-back service. There are different numbers for different needs (i.e., new accounts, trade desk, forex trading) so you can get specialized help. Hours and days vary depending on the number.

Email support is a third option, but it’s also the one that’s going to take the longest to receive a response. Many users report waiting two or three days for email responses, in fact.

If you happen to live in Toronto, you can stop by the Questrade Learning Centre for some face-to-face help. The Learning Centre is open from 9 a.m. to 5 p.m., Monday through Friday.

Questrade is an advanced trading platform that won’t kill you on commissions thanks to its variable and low-cost fixed pricing. While the pricing structure can be a little hard to wrap your head around at first, that’s true of pretty much any brokerage. Additional fees, while present, aren’t outrageous.

Beyond its discounted costs, the most convincing reason to give Questrade a try are the advanced brokerage tools it puts in your hands. The ability to research markets, track trends, and quickly buy and sell stocks, options, ETFs, bonds, and other assets.

If you’d prefer to pad your nest egg without working yourself silly, Questrade’s Portfolio IQ service is an affordable, worry-free way to do just that. No matter how you approach it, Questrade is a valuable tool for Canadian citizens of a broad range of economic means.