Table of contents

With nearly 30 years of experience in foreign currency exchange (forex) and contract for difference (CFD) trading, 15 offices around the globe, and over 60,000 clients worldwide, CMC Markets has long been established as one of the world’s leading retail forex and CFD brokers.

CMC Markets offers its clients access to a wide range of over 10,000 financial instruments, including forex, commodities, and security trading. Where user experience is concerned, CMC uses their own “Next Generation” trading platform, which is browser-based as well as available as a mobile app for Android and iPhone.

In addition to their large range of instruments, CMC’s education and analysis tools are robust and traders of all experience levels will be well-equipped to bring their trading to the next level.

Top Features of CMCMarkets.

CMC Markets allows users to trade with access to over 10,000 instruments from over 30 different markets including forex currency pairs, commodities, stocks, and indices. Digital 100s, spread betting, CFDs, and countdowns are just some of the trading instruments available.

Protections

In compliance with FCA regulations, all retail client funds are held in segregated accounts, apart from CMC’s general business account. All client funds are held in accounts with top-tier banks, such as Barclays, Lloyds, and HSBC in the UK. Outside the UK, banks include Ulster in Ireland, Deutsche Bank in Germany, and HSBC in Poland and Spain.

These banks are risk-assessed regularly by CMC to ensure solvency.

In accordance with FCA regulations, client accounts are unable to be accessed by CMC or any of their creditors. In addition, CMC performs daily client fund reconciliation so that client accounts accurately reflect client assets.

All CMC Markets accounts also feature negative balance protection, meaning that should you lose more than the totality of your account, CMC will not be able to go after your funds to make up for losses.

Types of Accounts

CMC Markets has both CFD and corporate accounts available. Within each of these categories, clients are able to choose between regular and fixed-risk accounts.

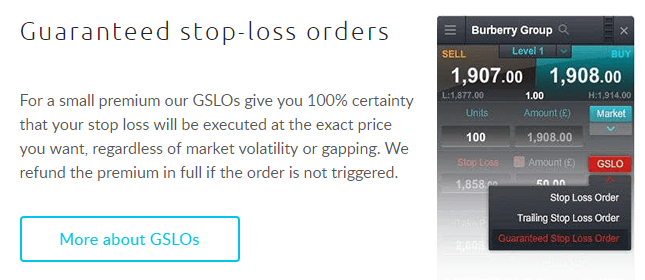

As there is no guaranteed stop loss protection, it is possible (unlike with most other online traders) to lose more than you’ve invested. For a small fee, fixed-risk accounts will carry guaranteed stop losses.

As with most online brokers, clients are also given the opportunity to try out a demo account in order to experiment with trading strategies and techniques, as well as become accustomed to the platform with absolutely no risk.

Types of Products

CMC Markets features over 10,000 products available for trading, including 348 forex pairs, 116 indices, 110 commodities, 4900 shares, etc.

Forex Pairs

The foreign currency exchange market is the largest market in the world, and CMC gives you more access to it than most other online brokers, with 348 different foreign currency pairs.

CFDs

CFDs (contracts for difference) are derivative products which allow you to trade on the price movement of underlying financial assets, including indices, shares, and commodities. CMC’s award-winning CFD platform gives you access to over 10,000 CFDs starting with 0.7 points on forex and 1 point on popular indices.

Spread Betting

Spread betting is a tax-free way to bet on the movements of thousands of financial instruments including commodities, forex, indices, and treasuries. When you spread bet, you take a position on whether a financial instrument’s price will rise or fall.

Digital 100s

Digital 100s, similar to CFDs, allow users to bet on changes in the market with limited risk.

Social Trading

CMC Markets has a feature which allows clients to display other traders’ chart annotations in your own platforms. Tracking Client Sentiment allows you to get trading ideas and find out what’s trending with other “All Clients” or “Top Clients.” Pattern recognition and other advanced trading tools are also available.

Trading Platform

CMC Markets’ “Next Generation” trading platform is an intuitive, well-designed, and 100% automated system filled with excellent features such as social-based analysis, charts, order entries, and a variety of other tools.

The Next Generation platform is browser-based and includes advanced studies, customizable charts, and customizable display styles and templates. The platform allows users to use complex order types with account analytics. Another positive feature of their platform is that research and analysis tools are built right into the platform, including market calendar, screeners, and social charting.

Despite the quality design of their trading platform, some users who are used to the MetaTrader4 platform will be disappointed that there is no MT4 option.

Fees and Commissions

CMC Markets has below average spreads for indices, large forex pairs, and commodity CFDs. There is a minimum and spread commission for single-stocks but no maximum commission, which can become pricey for larger traders. Spreads are not fixed and will vary with market liquidity.

There are no charges for normal withdrawals, and the inactivity fee does not kick in until two years without activity.

Education

CMC’s tools-based education, featuring Youtube videos, is a well-organized and helpful section of their site. Their analysis tools are focused on streamlining analysis as well as finding new trading opportunities and helping clients to understand market trends.

These include the following:

- pattern recognition

- client sentiment gauge

- boundary spread bets

- Reuters news

- price alerts

For more focused educational opportunities, CMC offers their eight-week ‘Trading IQ’ course, which not only educates newer traders but upon completion, offers a free trading day. Users who make profits on this trading day are entitled to keep them, but should you happen to fail all losses will be covered by CMC.

Charting Packages

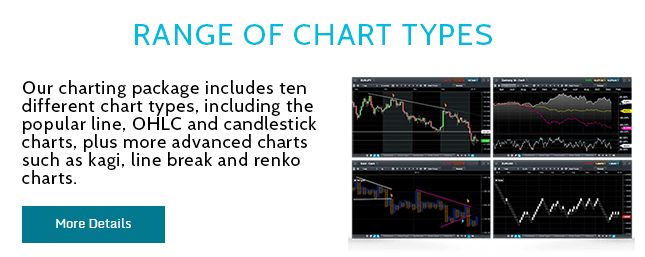

CMC Markets features a deft, incredibly helpful proprietary charting package, with a series of complex charts to aid with your market analysis.

Traders have the ability to choose between 10 different types of chart types, as well as 24 drawing tools, which help annotate charts to highlight key trading patterns. There are also 26 technical overlays available, and 48 technical studies, using up to 20 years’ worth of backtesting.

CMC’s mobile charting package features over 20 technical indicators and ten drawing tools, live streaming charts, and zooming and dynamic lines in their “crosshair” function.

The Pattern Recognition Scanner, which is part of the charting package collating data from over 120 tradable assets bringing awareness to technical trading opportunities.

Traders on the CMC platform are connected through the Chart Forum, where they can discuss, copy, and share technical analyses.

Opening an Account

Once users have decided to open a CMC trading account, there is an online application form they must fill out, along with including certified documents as proof of identity. Within the UK, applicants will receive a response within 60 seconds of application. Outside the UK, applicants should expect a response within a few days.

Although CMC recommends a minimum start amount of 1000 GBP, the minimum beginning deposit on CMC’s UK platform is 200 GBP. Deposits can be made using credit/debit cards or bank wire transfers, neither cash nor check is accepted. Traders should be warned that although there is no fee from CMC, retail banks will usually charge a fee for wire transfers.

CMC Markets.com Prices

CMC’s pricing is highly competitive with spreads as low as .7 pips and typical spreads of .772 pips.

Criticism Of CMC Markets.com

Some minor criticisms of CMC Markets include the fact that neither BitCoin nor any other crypto-currencies are available on CMC Markets.com. There is also a minimum commission for single stock trades. Despite this fact, there is no maximum commission, which means that commissions can get expensive for larger traders.

Traders who are accustomed to MetaTrader’s interface will be disappointed to learn that there is no automated trading through MetaTrader on CMC. Nor are there expert advisors to consult with, backtesting, or VPS.

Risk protection doesn’t seem to be as high a priority as it does with other online brokers, as their account protection is the absolute minimum for what’s required by UK regulators, and traders are not allowed to use custodian banks to hold their assets.

Customer Support

CMC Customer support is available whenever markets are open via phone, fax, email, or online chat. Their customer support has been reported to be quick to respond, courteous and knowledgeable.

The support website has a searchable archive and good knowledge base regarding order types and trading platforms.

CMC Markets has established a firm foothold in the marketplace with almost 30 years of experience in forex and CFD trading. Because of this time in the game, they have a large amount of savvy, but also may be a bit stuck in their ways.

We were surprised to note that unlike many online brokers, clients are capable of losing more than their deposit unless they opt in for guaranteed stop-loss protection. We were also surprised by the absence of the MetaTrader platform, which has quickly become the industry standard, and many traders have gotten used to.

CMC Markets does have a long track record, though, as well as all standard protections, and solid education and charting packages. Users who like a smart, well-thought-out interface will be pleased with CMC’s systems.