Table of contents

The Internet has made it increasingly simple for people to invest in a variety of markets. Instead of spending a lot of money buying and selling through brokers, investors can take control of their finances by using online trading platforms.

Developing technology continues to make it easier for traders to get information and access trading platforms from their own homes. Before deciding to invest money in these trades, though, investors should explore their options. There are plenty of companies that focus on specific types of traders. The more you learn about those options, the more likely it is that you will choose one that’s right for you.

Introduction to ETX Capital

ETX Capital got its start in London as Monecor Ltd in 1965. In 2002, the company expanded to offer retail derivatives via TradIndex. The company changed TradIndex to ETX Capital in 2007. In 2010, ETX Capital created a German version of its trading platform and website to take over Worldspreads, a German company that had gone bankrupt. The company has since expanded to Italy and France.

ETX Capital gives its members a variety of ways to invest their money. Spread betting, forex, and contract for difference products are popular options.

Since the business is regulated by the Financial Services Authority in the United Kingdom, it can only serve clients who live in certain locations. While it has an international audience, it is not considered a global trader.

ETX Capital Services

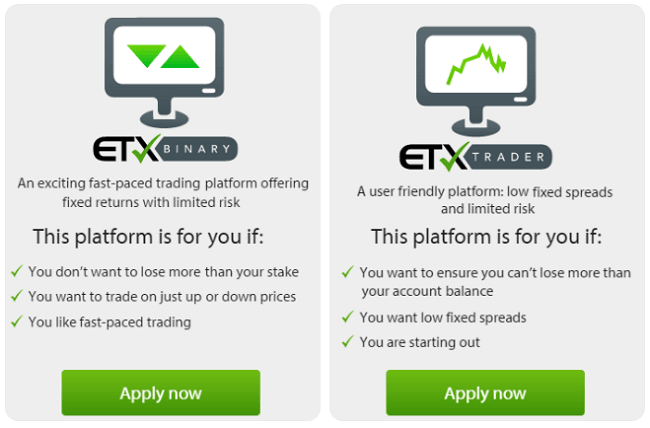

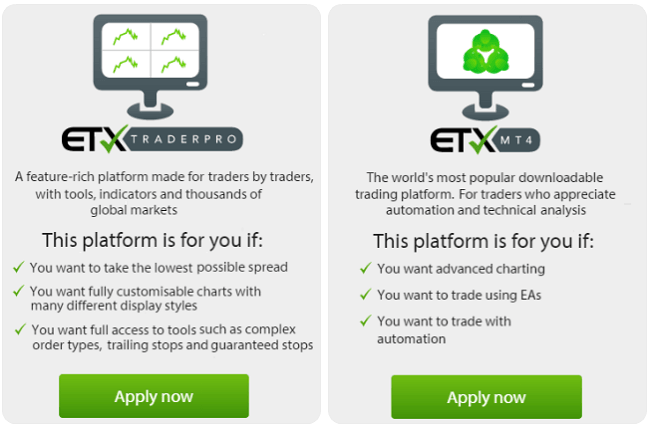

ETX Capital uses four platforms to meet the needs of its clients. Since each platform offers its own features and services, clients should learn about them before making any commitments.

EXT Binary |

EXT Trader |

| ETX Binary is a fast-paced trading platform that lets investors earn fixed returns without adding too much risk to their portfolios. People who like ETX Binary typically want simple trading options that won’t let them lose too much money at once. It’s a good option for those who want to make a little money without risking their nest eggs. | ETX Trader is a simple platform that even beginners can use. Members who use this option cannot lose more money than they put into their accounts. That’s a great option for investors who want to earn money, but worry that they might lose more than they can afford. If you’re just getting started and you want low fixed spreads, this is probably a good option for you. |

ETX Trader Pro |

ETX MT4 |

|

ETX Trader Pro is for experienced traders who want to consider as much information as possible before making trades. The platform comes with abundant tools and indicators for markets all across the world. It’s a good option for people who want low spreads, customizable charts that help them organize and interpret data, and tools that automate basic trade decisions. |

ETX MT4 was designed for traders who believe that automation can give them an advantage over others. The platform providers plenty of technical analyses so traders can make informed choices. The advanced charts let traders customize how they see data. If you have a lot of experience and you’d like to take your trading to the next level, this is probably a good choice. It’s extremely popular among ETX clients. Unfortunately, ETX MT4’s automated options does not include a guaranteed stop. |

ETX Capital Features

ETX Capital’s features give clients plenty of educational tools so they can better understand their options. Popular features include:

- Market commentary to help traders understand why markets behave the way they do

- Video commentary for visual learners and repeat views

- A real time newswire that provides the latest information that could affect your trades

- A morning brief that lays out some important expectations for the day

ETX Capital gives traders opportunities to earn money through forex, equities, commodities, and indices. Traders who aren’t experienced with these markets will want to learn as much as possible from the provided educational materials.

ETX Capital’s Facebook application lets clients make fake trades. This feature gives traders practice so they can hone their skills. Those who make successful fake trades may also qualify for prizes.

Comparing ETX Capital With Competitors

ETX Capital has some strong characteristics, but, despite its age, it has a fairly narrow scope when compared to online traders like IronFX. Traders located in the UK, France, Italy, and Germany, however, will likely get good services from ETX Capital.

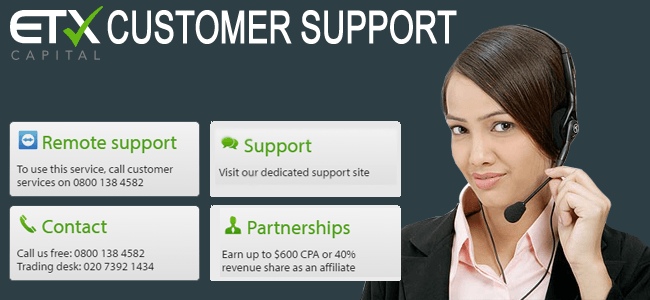

ETX Capital Customer Service

ETX Capital has a customer service hotline that’s active 24 hours a day. The company also has some social media profiles where users can ask questions. Unfortunately, the company doesn’t offer online chatting and its customer service reps answer emails slowly.

ETX Capital excels in some areas. Customer service isn’t really one of them. It’s fair at best.

Frequently Asked Questions

Investors who want to start using online platforms should make sure they fully understand their options before funding their accounts. These are just some of the questions frequently asked by investors. If you have other questions about ETX Capital, you should contact the company directly.

[+] Does ETX Capital Offer Any Bonuses or Incentives?

Yes, ETX Capital does offer bonuses and incentives, but clients may find some of these offers misleading. For instance, the company promises a free educational course that’s valued at £500. Unfortunately, the courses are similar to those offered by most trading sites. Anyone expecting to get an education worth £500 will be disappointed.

The business does, however, offer some other incentives. Those who refer friends to the site can get bonus cash in their accounts. These incentives and bonuses change fairly often, so it’s important to learn more about current offers.

[+] Does ETX Capital Offer Mobile Access?

ETX Capital offers 24 hour access to their website and trading platform via computer and most mobile devices. Currently, the company supports trading platforms that work on Apple, Windows, and Android operating systems. Linux is not currently supported.

[+] Does ETX Capital Offer a Safe Way for Clients to Add Funds to Their Accounts?

ETX Capital lets clients choose from several secure funding methods. The specific type of method you can use, however, may depend on your location and how much money you want to add to your account.

Pros of Using ETX Capital

- ETX Capital has a well organized website that’s easy to navigate

- The trading platform has a short learning curve that lets investors get started quickly

- The company offers a strong educational program that helps clients understand their options

- ETX Capital has a 24-hour customer service hotline

- £100 minimum balance is affordable for most traders

- Trade competitions with prizes

Disadvantages of Using ETX Capital

- Misleading special offers can make clients feel cheated

- Although the 24-hour hotline offers good customer services, it’s difficult to reach representatives online

- Limited access to investors outside of a few countries

- No demo account option

- No guaranteed stops on automated platform

Conclusion

ETX Capital has strong platforms that will meet the needs of most traders. The low minimum balance makes it attractive to people who have just gotten interested in making money by betting on equities, forex, and other markets. The excellent educational programs may also attract people beginners who are interested in learning whether they can make money by trading online.

The company, however, may not appeal to the most experienced traders. Those who expect daily, in-depth market analyses may feel disappointed. Those who want more information and sophisticated systems may want to explore other options. Those who want to learn about trading, however, should definitely consider using ETX Capital