Table of contents

Online Forex trading has become a popular way for people to make money without investing large amounts of cash. There are hundreds of online brokerages that give people from all walks of life easy access to trading platforms. Improved Internet technology has made it even easier for investors to find reliable online brokerages.

All investments, however, carry some risk. This makes it important for traders to research brokerages before opening accounts. In most cases, brokerages have earned good reputations by offering their members educational materials, analytical tools, and fast executions. With so many options, though, it makes sense for beginning and advanced traders to do a little extra research. Reviews like this one can help, but it’s each person’s responsibility to make sure he or she chooses a reliable brokerage with the right services.

Introduction to Pepperstone

Pepperstone is a relatively new online brokerage, but it has gained exceptional popularity. Formed by Owen Kerr and Joe Davenport as an Australian Forex exchange in 2010, the company already has offices in Melbourne, Dallas, and Shanghai. In 2012, the company introduced EDGE FX as an alternative to the MetaTrader 4 platform.

Pepperstone received a lot of attention in 2013 when Australian Financial Review published a rumor that the company planned to go public. This rumor never came true. Pepperstone is still a privately held company.

Had Pepperstone gone public, its stock would probably have sold at high prices. According to the company’s figures, it has an annual customer growth rate of about 20%. It also claims that its Forex transactions come to about A$12 billion per month.

Pepperstone values say the company is committed to:

- Offering the best services

- Innovation and flexibility

- Acting responsibly

- Promoting ethics and integrity throughout the industry

- Upholding high regulation and compliance standards

Pepperstone Services

Pepperstone offers numerous account options. Prospective members should compare the features of each account to choose one that matches their unique needs.

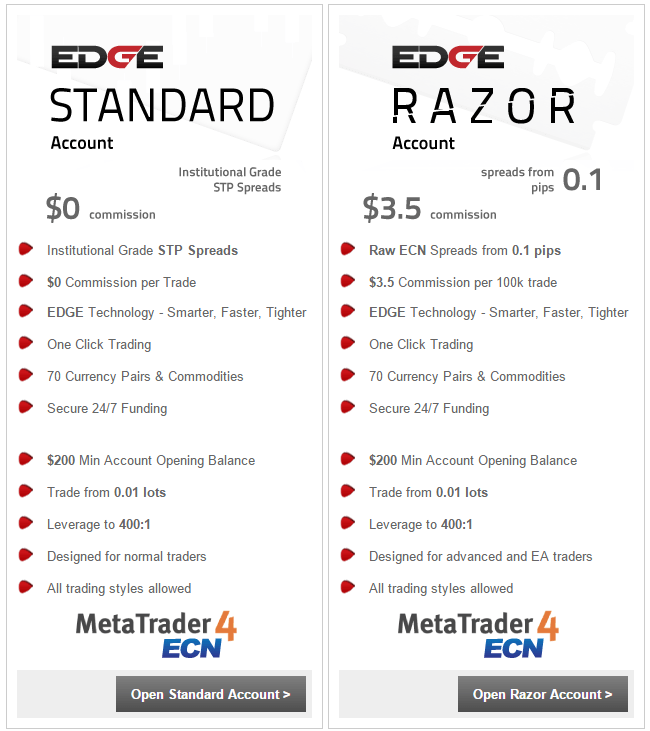

Standard Account

The EDGE Standard Account is designed to meet the needs of normal traders. It requires a $200 minimum balance. Some of its features include:

|

|

|

|

|

|

Edge Razor Account

The EDGE Razor Account is designed to meet the needs of advanced traders who want to deal in higher volume. The account has similar features to the Standard Account, but members also get:

|

|

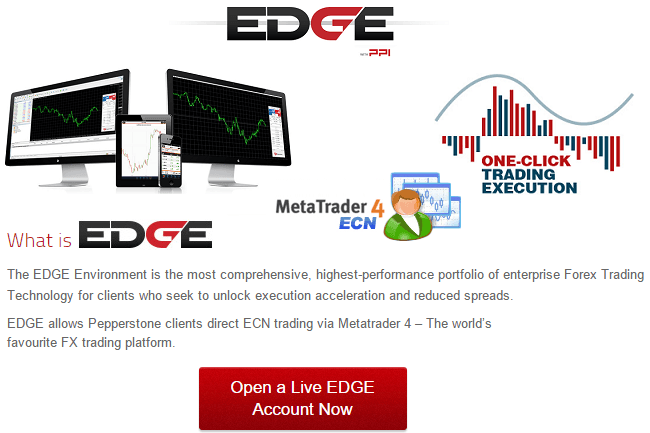

Prospective members can also download a free demo of MetaTrader 4 to try the software. The demo does not include access to Pepperstone’s EDGE FX Trading Platform.

Islamic Account

Pepperstone developed its Islamic Account to meet the needs of people who, for religious reasons, cannot receive or pay swaps. This account option conforms with Sharia law.

Some features of the Islamic Account include:

- $0 commission

- Complies with Sharia law

- 1.2 to 1.8 pips average EURUSD spread

- Straight through processing with no swaps

Comparing Pepperstone With Competitors

Pepperstone reviews point to a trusted and respectable company. Of course, not every trader is 100% happy. Common complaints include:

- Slow, unreliable tick count

- Problems with price and order executions

- Slow withdrawals

- High slippage that leads to lost revenues

Many online Forex brokerages receive these complaints, therefore interested clients shouldn’t read into these criticisms too much.

Pepperstone Customer Service

Pepperstone gives customers several way to get assistance. They can use the website’s Live Chat, send emails, or contact the office by phone or fax. These are the communication options that today’s traders expect from online brokers.

Frequently Asked Questions About Pepperstone

[+] What account funding options does Pepperstone accept?

Pepperstone accepts wire transfers and credit card deposits.

[+] Does Pepperstone accept U.S. clients?

No. Pepperstone has an office in Dallas, but CFTC regulations prevent it from giving U.S. residents access to Margin FX trading.

[+] Does Pepperstone offer mobile trading services?

Yes, Pepperstone offers mobile trading via apps designed for iPhone, iPad, BlackBerry, and Android devices.

[+] What customer support languages does Pepperstone use?

Customers can get support in Chinese, English, Japanese, and Russian.

[+] Why does Pepperstone offer an Islamic Account option?

Some Muslims believe that swaps violate Sharia law. This prevents them from using most online Forex brokerages. Pepperstone offers an Islamic Account option that does not use swaps so religious people can use the service.

[+] Where does Pepperstone keep the funds members put in their accounts?

Pepperstone keeps client funds in segregated accounts at HSBC and the National Australia Bank.

[+] What documents do I need to open a new account with Pepperstone?

Pepperstone uses 100 Point ID Check. New members need a primary photo ID, such as a passport or driver’s license, and a secondary ID, such as a birth certificate or credit card statement.

Pros of Using Pepperstone

- Exceptional liquidity makes it possible for professional traders to place large bids

- Offers automated trading

- Allows hedging

- One click trading

- Offers gold and silver trading

Cons of Using Pepperstone

- Does not accept clients from the United States of America

- Has received some negative reviews from disgruntled users

​ - Limited research or analytical tools

Conclusion

On the surface, Pepperstone looks like a great brokerage. It doesn’t offer as many educational or analytical tools as some of the world’s top online brokerages, but it has a stable trading platform and a lot of members. Review your options and talk to their friendly company representatives before funding an account with Pepperstone.