Table of contents

What makes TMGM Global broker stand out from other brokers?

Trying to get the best deal can be very challenging. Not all traders are willing to give up their time or make sacrifices. If you want to save money and stay competitive, then TMGM Global Broker might be your solution.

This broker has been in operation since 2013. They claim they provide the best trading conditions to both beginners and experts. Moreover, you can access their services 24/7 and trade through multiple devices such as PC, smartphones, and tablets.

If you’re looking for a reliable broker that will offer you the best possible trading experience, you should consider TMGM Global Broker. Continue reading the rest of the article to learn everything you need about the TMGM Global Broker.

About TMGM.com

What is TMGM Global Broker?

To put it simply, TMGM Global Broker is an online brokerage firm that offers its clients various financial products and services such as Forex trading, CFD trading, Stocks, Cryptocurrencies, Indices, Commodities, Futures, ETFs, Options, Bonds, Mutual Funds, and more.

The company was established in 2013 by two experienced traders who wanted to create a platform where people could enjoy the benefits of trading without worrying about the technical aspects of trading. The founders had previously worked at some of the world’s largest banks and investment companies before deciding to start their own business.

With its proprietary research content, TMGM trails behind the market average with its research content. Its blog is good at providing market commentary, but its articles often lack the images, charts, and tables that are typical in research updates provided by the leading financial institutions.

Many of the research at TMGM are powered by Trading Central (i.e., we use the platforms’ tools). For example, if you check out our blog, you may see articles written using these tools. With them, we provide a sentiment-driven heat map for instruments and an economic calendar.

TMGM’S blog comprises daily market commentaries and contains technical and fundamental analysis. However, their articles lack variety since they consist mostly of marketing materials and a few posts on how to use their tools.

Most of TMGM’s customers come from the United States, Canada, Australia, New Zealand, Europe, Asia, and Africa. Their customer base includes individuals, small businesses, large corporations, and even hedge funds.

These are genuine challenges – If you want to pass them, you need to read the material carefully or be an expert in the subject matter. TMGM has developed an extensive set of online courses covering everything from the basics to advanced topics. It is a perfect tool for understanding the theory behind forex and CFD.

The platform’s educational content pays close attention to the finer details, including tracking and providing real-time feedback on your progress. Reputable sources awarded it the best class rating.

Why Should You Trade With TMGM?

There are many reasons why you should choose TMGM over any other broker. Some of the most important ones include:

1. Low Spreads.

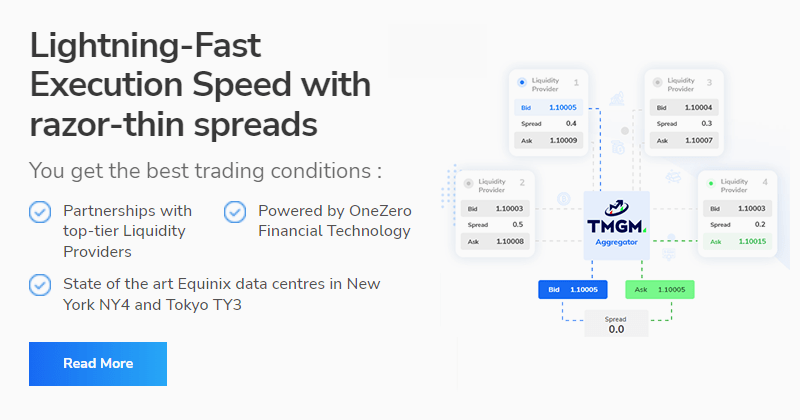

One of the biggest advantages of trading with TMGM is that they have low spreads. Traders can expect to pay only 0.2 pips per lot when trading stocks. In addition, they charge just $0.01 per contract for forex trades.

2. Fast Execution Times.

Another advantage of trading with TMGM is that they execute orders quickly. Orders usually take less than 30 seconds to get completed.

3. Accessibility.

You don’t have to be tech-savvy or know anything about cryptocurrency to trade with TMGM. They do all the hard work for you to focus on your strategy.

Top Features of TMGM.com

1) High-Quality Customer Support

One of the things we like most about TMGM is its customer support. Their team members are available 24 hours a day, seven days a week. You can reach them via phone, email, live chat, and even social media platforms.

2) Low Spreads & Commission Fees

TMGM provides low spreads and commission fees on all trades. For example, if you deposit $500, you will only pay 0.3 pips per lot.

3) Best Trading Platform

TMGM uses some of the most popular forex trading platforms today: MetaTrader 4 (MT4), its own proprietary platform, and a Desktop platform (Windows). It allows users to trade using any device or operating system.

4) No Restrictions on Leverage

With TMGM, you can leverage up to 1:1000. That means you can invest as little as $10 and still earn high profits.

5) Multiple Languages

All TMGM’s services are offered in English, Chinese, Japanese, Korean, Spanish, French, German, Russian, Italian, Portuguese, Arabic, Persian, Turkish, Indonesian, Hindi, Polish, Ukrainian, and more.

6) Free Training

When you join TMGM, you get free training materials. These materials cover topics such as how to open an account, what types of instruments you can trade, how to manage risk, and much more.

7) Various Payment Methods

You can choose from several payment methods, including credit cards, debit cards, eWallets, PayPal, Skrill, Neteller, WebMoney, and others.

8) Easy Deposit Methods

You don’t have to go through complicated procedures when depositing funds into your account. Just use your credit card, debit card, bank transfer, or wire transfer.

9) Mobile Apps

You can download TMGM’s mobile apps for iOS and Android devices if you want to access your account while away from home.

10) Demo Account

You’ll be happy to know that TMGM has a demo account if you’re new to forex trading. This is a virtual version of your real account which gives you a chance to practice trading before making actual deposits.

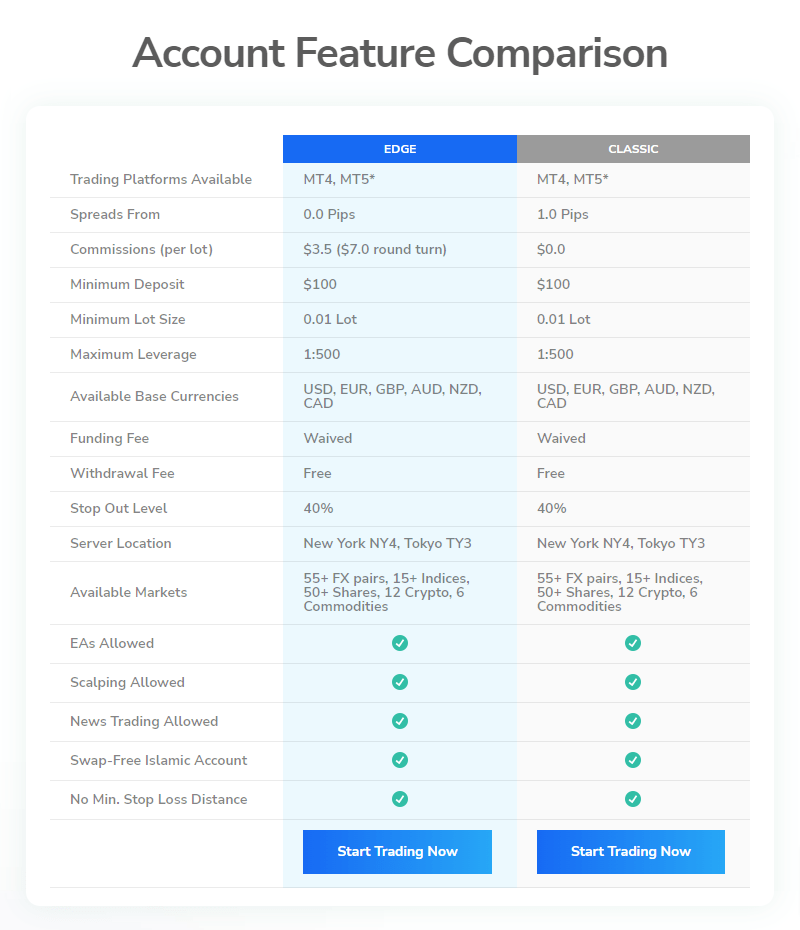

TMGM Commission

TMGM has some of the lowest commission rates for its accounts, with low spreads and no changes in the quotation after some time. However, certain conditions apply.

Your trading costs at TMGM will vary depending on whether you opt for the spread-only Classic or the commission-based Elite accounts. If you opt for the Elite account, you’ll pay a small commission of $3.5 per side ($7 per round trip).

For example, if you deposit $100, then your first withdrawal will incur a fee of 2% of the total amount deposited. If you withdraw between $100 and $500, then the fee will be 3%. And if you withdraw over $500, then the charge will be 5%.

In addition, if you close your account within 30 days of opening it, then you will also be charged a monthly maintenance fee of $25.

Customer Support

The company offers excellent customer service. Its representatives are always ready to help traders with their questions regarding the platform, trading strategies, and other issues. They respond to emails and live chats quickly.

The company is verified through Trustpilot with a very respectable 4.9 rating, where most of the comments praise the service and customer support.

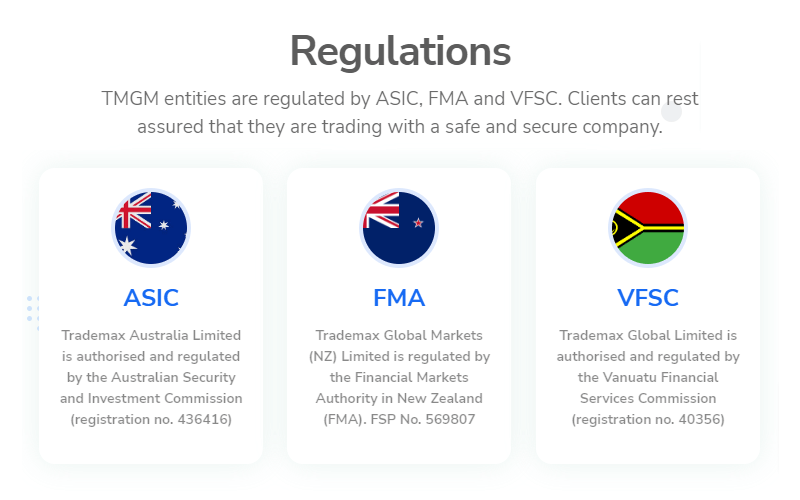

TMGM Licenses and Regulations

TMGM has regulatory licenses for its operations in Australia with ASIC, New Zealand with VFSC, and Vanuatu with VFSC. TMGM’s licensed operation includes offices in Sydney, Melbourne (Australia), Adelaide, Canberra, Taipei, and Auckland (New Zealand).

TMGM has an overall trust score of 79 out of 99, which puts it in the average-risk category. It is not publicly traded and doesn’t operate a bank. TMG is authorized by two-tier one regulators, zero tiers two regulators, and one tier three regulators.

Disclaimer: Trading foreign exchange on margin has a high level of risk. Leverage can work against you. Consider your investment goals, the risk, and your experience before investing.

Do not risk money you can’t afford to lose. By putting money on the line that you do not have, you could lose significant funds and get into debt rather than gaining cash.

Seek advice from a reputable financial advisor before getting involved in any sort of investment so you have guidance and help if you need it. Only invest within your capabilities and don’t take unnecessary risks.

Final Thoughts

We think that TMGM is a great choice for anyone who wants to start investing in forex, commodities, indices, Futures, Cash DMA Stocks, Options, Bonds, and ETFs. The company offers a wide range of features that allow traders to enjoy their experience.

We highly recommend this broker platform to everyone looking for a reliable and trustworthy forex broker.

Editor rating

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.