Table of contents

There are two main complaints in the forex world that can cost traders money while benefiting the exchanges and brokers. One company has risen to address both of these issues, which are a lack of cost transparency per unit and the inability of other brokers to fire off immediate trades without time slippage. This company’s name is now synonymous with excellence and that is the LMax Exchange.

About LMax.com

By stepping in with the previously mentioned disruptive improvements, LMax.com earned the number one ranking in the 2014 Sunday Times Hiscox Tech Track 100 league table, outperforming other brokerages and firms with their unparalleled annual growth rates. As you browse their website and learn more about their operations, you are reaffirmed that they are playing on a bigger field than other forex brokerages.

By the sole fact that LMax takes on institutional and interbank clientele as well as individual professionals, we can be assured that their infrastructure in terms of software, hardware, and staffing is more than sufficient for our personal needs. Their API access and half a dozen trading platforms gives you access to 67 currency pairs along with bullion, indices, and commodities in the format with which you’re comfortable.

This high level connectivity and processing capacity means high-volume traders with automated solutions can forget about encountering issues and staying on the phone with customer service and can stay focused on making money.

Top Features of LMax

LMax’s offerings include all of benefits you’d expect to find at any quality brokerage, but then they surprise you by surpassing everyone with their expertise. How can they not with banks and institutes as clients? The best of their features can be easily summed up with a list of key advantages. You should still be aware of the other benefits as well such as their access methods and trading platform options.

Key Trading Advantages

Where LMax succeeds over others is in what they term their key trading advantages. For instance, their pre-trade and post-trade transparency through immediate and historical data lets you verify the truthfulness of cost and honesty in LMax’s operation. You can also achieve full market depth through their open order book, building more trust that there is no collusion or directing your trades to specific entities. You will obtain the most fair cost at the time.

Despite the fact that the average latency per trade is only 4 milliseconds, LMax still has developed a price/time matching algorithm to ensure that you receive the price you ordered for. Time slippage and paying for extra pips won’t happen here. In addition, your trades are kept completely anonymous on your side and on the opposite. Nobody will know who the other party is, meaning there will be no last-looks or rejections of your trades (another aspect which can slow trades). LMax has the forex game in the bag and you can have a piece of the pie with their list of trading platforms and methodologies.

Trading Platforms and Access Methods

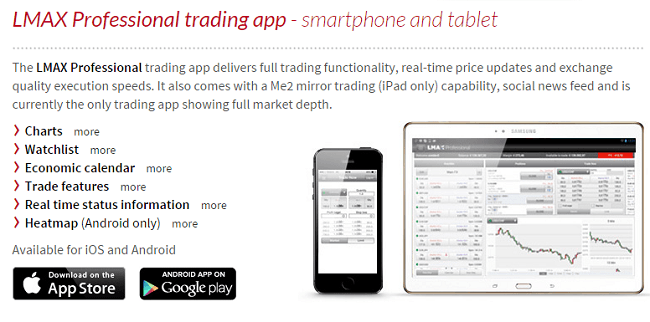

The beauty and familiarity of Metatrader 4 and 5 are still at your fingertips with LMax in addition to their array of proprietary mobile and tablet applications. You can find your style and push hard through the long list of bridge providers, managed network providers, virtual private server rentals, and API trading abilities. Speed and volume is the key here, allowing traders to scale to amazing heights.

LMax Prices

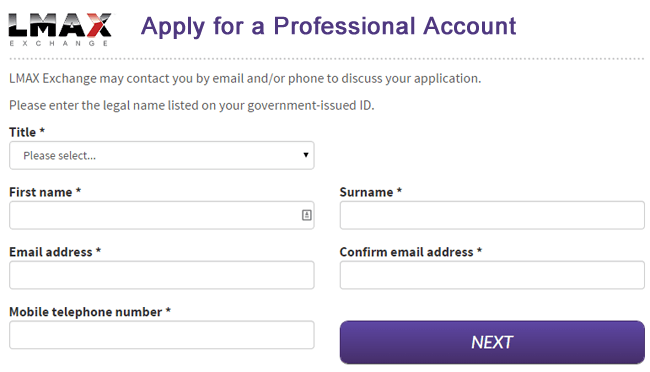

With LMax, unlike other firms, joining as a client is not as simple as signing up and funding an account. There is quite a bit of paper work to sift through before being approved. Yes, there is an approval process. Not everyone is accepted and allowed access to the prestige and power of LMax.com. This means there will be more resources for you since the network and customer service won’t be jammed full lower level misunderstandings and problems.

The minimum deposit also shows you how serious LMax is, and your ability to fund it shows them that you’re a professional trader. The minimum initial deposit is $10,000, which is easily a thousand times higher than other firms. Fortunately they accept funding in ten different currencies so you won’t encounter any roadblocks there.

It’s also important to understand that there is no one steady price that can be stated. The LMax Exchange spreads are variable over time, but they do offer access to historical data so you can see the trends and ranges over which you can expect to pay. Although you won’t pay commissions, the cost of trading will grow with the volume at which you trade.

Criticism of LMax.com

As a user of LMax, and corroborated by others online, there are only two main complaints of the service. The first complaint is solely the barrier to entry. Many traders are hobbyists hoping to go fulltime and become professionals. The $10,000 minimum deposit is very steep for anyone not already entrenched and established in the market. Whether that’s a legit complaint is questionable, but it’s the largest gripe with the company. I imagine this is what allows them to offer such amazing customer support though since the volume of their traders and especially “young, trouble traders” is lower.

The second criticism of LMax.com is a bit more justified. Many traders want to play the cutting edge and take advantage of “news trades,” meaning they slam the network with a large volume of trades whenever a new discrepancy arises between currencies. LMax doesn’t explicitly say they don’t support this style of trading until you begin attempting it. They will provide the news but won’t allow access beyond the headers and limit these trades in order to keep their system clear for large volume non-news trades. This is something you should definitely keep in mind if this is your style.

Customer Support

The benefit to trading with a company of such prowess is top-notch customer service. Access to the client helpdesk is available 24 hours per day from Sunday through Friday. That means there is only 24 hours per week where you won’t be able to reach anyone immediately, which beats most other firms. The support desk can be reached in a multitude of languages through the phone, live chat, or email.

While I’ve not personally needed to contact them, further prove of their advanced setup, I did try to find instances of others having bad experiences and simply couldn’t find any on the internet. I would expect nothing less of a distinguished exchange such as LMax, knowing their global-scale clients would accept no less as well.

Conclusion

Ultimately, if you’re expecting to trade with the London Multi-Asset Exchange, you’ll need to be a large-volume professional, an institution, or an interbank. This is great news if you fit the bill because their infrastructure is one of the few that will support high-level individuals. You won’t be able to take advantage of news-trading but you’ll have access to virtual private servers to scale your automated processes through their API access, proprietary mobile and tablet applications, and the common options such as Metatrader 4.

You won’t find lower levels of latency or such powerful time-matched algorithms. This essentially guarantees no slippage, meaning you’ll know exactly the value of each trade as you pursue riches. This is a must. Full transparency, efficiency, and regulated capital allows you to forget about the other concerns of the game and get right down to the nitty gritty. If you’re ready for the big leagues, you’ll be more than happy to apply at Lmax.com.