Risk Warning: Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

Table of contents

Their unique layout and user-friendly interface make it ideal for new traders, and those who wish to understand the risks in a straightforward manner. With several broker platforms out there today, it can be challenging to know who to trust and who to turn to for advice. Deriv relieves this confusion and offers some distinctive features that set it apart from its competition.

History of Deriv.com

Regent Markets Group was founded in 1999 by the Regent Pacific Group Ltd. The goal was to create an algorithm with a fixed-odds trading system for retail investors, becoming the first in the world.

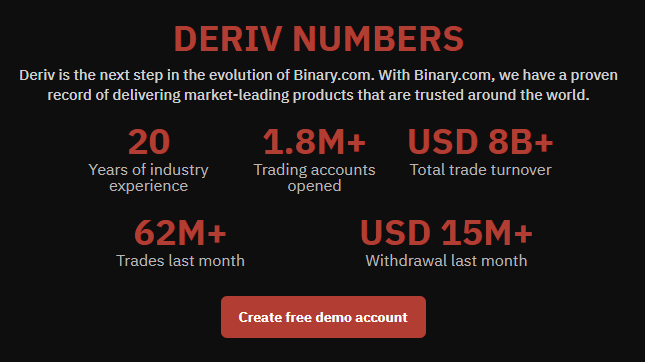

In 2001, the group launched BetOnMarkets.com, which was the first platform to offer binary options for traders interested in retail. In 2013, the site rebranded to become Binary.com and, in the following years, created a more user-friendly interface with several useful functions.

The Binary Bot and the Tick Trade app are among the best features of the new online trading experience. Deriv has been considered the next step in Binary.coms evolution towards an interactive and advanced trading platform.

Top Features of Deriv.com

Despite its launch in 2020, Deriv.com is backed by masters in web-development, online accessibility, and customizable applications. Several features stand out and make Deriv one of the leaders in the industry.

User-Friendly Interface

The user experience must have been at the forefront of the developer’s minds. It’s evident upon first glance that Deriv is based around its users and implements an ease of understanding when utilizing its interface.

The charts and graphs depicted on their app make it easy to follow along. While their interface is perfect for beginners, there are also several functions, including the DMT5 account, which offers in-depth technical analysis.

DTrader and SmartTrader have incredible turnaround and make trading quick and simple. While expiry times do vary between the two (refer below), the system itself is unparalleled.

Multiple Translations

Perhaps one of the most fascinating attributes of Deriv.com is the ability for the site and applications to be translated into eleven different languages. Among these are English, Spanish, French, Portuguese, Chinese, Thai, and Polish. The multiple translations set Deriv apart from its competition.

Great For New and Experienced Traders

Several different functions work for a variety of traders to aid in anyone’s needs. DTrader is easy-to-use and offers a simplistic approach to trading. DBot offers automation. DMT5 is considered the all-in-one FX and CFD trading platform. While SmartTrader showcases the world’s markets with a user-friendly platform.

Types of Trade Accounts

One of the best features of Deriv.com is the variety of accounts to choose from. Additionally, if you want to test out the applications listed below, Deriv offers a free demo to gain a feel for their platform.

DTrader

DTrader is a customizable platform with a little over fifty trading assets. The charts are tailored to the user, and all widgets and settings are flexible. Position sizes, trade duration, and data can all be changed to appeal to the user.

SmartTrader

SmartTrader is the all-encompassing trader for Deriv.com. It’s based on a user-friendly interface so that new and experienced traders can begin with as little as a dollar. Unlike DTrader, SmartTrader is not reliant on quick ticks and short expiry, making it easier for beginners.

DBot

DBot is the automation trader for Deriv.com. It’s a straightforward platform for algorithmic investing and works with up to fifty assets.

DMT5

DMT5 is Deriv.com’s account for experienced users. It is integrated with in-depth analysis and research tools to help users maximize their investments. Trade sizes, widgets, data, windows, and leverage are all flexible and customizable. This platform also hosts the most assets, reaching around seventy total and soon to be increasing.

Deriv.com Commission and Costs

What is most interesting about Deriv.com is that there is no commission to trade. This is in relation to DTrader and SmartTrader as CFD trades on DMT5 will include commission, but this is to be expected.

Unfortunately, the site is still relatively new, meaning that data on this information is limited. However, Binary.com had a reputation for transparent fees and was notable for tight spreads, so this may offer relief to some.

Assets and Expiry Times

There are over one hundred products available on Deriv. The assets are comprised of currency pairs, stock indices, synthetic indices, commodities, and cryptocurrencies.

On DTrader, expiry times can be anywhere from a few ticks to a few minutes. Some people have experienced days on SmartTrader. Despite this, the expiry times are relatively flexible. If you’re looking for something quick, it’s best to opt for DTrader. Otherwise, SmartTrader should suit your needs just fine.

Deposit and Payment

Deriv deposits and withdrawals work quickly, often only taking one to two business days. The minimum deposit and withdrawal are between five and ten dollars, and you may use any standard payment method: cards, bank wires, e-wallets, etc. The minimum for cryptocurrencies is flexible and ever-changing, but Deriv is great at keeping up-to-pace with the fluctuation of the market.

There is no fee for withdrawal, which is one of the reasons so many traders favor Deriv.

Customer Support

Deriv.com offers a Help Center where you can find frequently asked questions and their answers. Fortunately, there’s also a Live Chat, which many users prefer to use for instant responses. When it comes to returns, Deriv is average. You can expect a bit of fluctuation depending on the situation.

Deriv.com Licenses and Regulation

Since Deriv.com is a part of Regent Markets Group, it has the maturity and security of an old-timer in the field. The licenses and regulations of Deriv.com are listed openly on the site under the About Us section.

Some of their regulated jurisdictions include:

|

|

All branch and jurisdiction information can be viewed from their site. While heavier restrictions exist for citizens of the USA, Canada, and Hong Kong, Deriv certainly meets all of the necessary regulations.

Drawbacks

One of the main drawbacks of Deriv is its limited asset-lineup. There is still ample room for finding fantastic trading opportunities, but the selection rests around one hundred. Other brokers have been known to offer hundreds of trading options. Of course, this may change in the future as Deriv is still a young site.

One of the main drawbacks of Deriv is its limited asset-lineup. There is still ample room for finding fantastic trading opportunities, but the selection rests around one hundred. Other brokers have been known to offer hundreds of trading options. Of course, this may change in the future as Deriv is still a young site.

Another drawback may be the limitations among the different Deriv accounts. For those who enjoy advanced trading, DMT5 is an excellent choice. Additionally, specific withdrawal methods like MasterCard are only available for UK citizens. Thankfully, as a payment method, MasterCard is available for all countries.

Final Thoughts

Deriv is a new site with great potential. It offers several desirable attributes that make it ideal for new and veteran traders. While the lack of sign-up bonuses may deter some, Deriv offers a few amazing qualities.

It’s user-friendly interface, no fee/no commission trades, and its up-to-speed data makes it a wonderful brokerage to work with. The versatility of the accounts and platforms offered by Deriv are also appealing. It wouldn’t be surprising if Deriv became one of the more popular trading applications to use.

Risk Warning: Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.