Table of contents

FBS is an online broker that can place Forex, stock, CFD, and cryptocurrency orders on your behalf. Is it a good option for your trading needs?

Our FBS.eu review will give you a better idea of what to expect from this broker.

About FBS.eu

FBS.eu is a trading platform that specializes in Forex trading, stocks, and CFDs for energy, metals, and other commodities. This broker also offers a cryptocurrency investment platform.

FBS is a brand used by the broker known as Tradestone. This company has been around since 2009 and counts over 17 million clients worldwide.

FBS has won several awards, a testimony to the broker’s ability to manage funds safely and deliver a quality service.

Top FBS Features and Reasons to Use FBS

What makes FBS better than other Forex brokers? With a reliable digital platform and slightly lower fees, FBS has established itself as a popular option among Forex day traders.

Different Types of Accounts

Everyone has different goals and experience levels when approaching Forex trading. FBS offers different types of accounts with services and limits that reflect the unique situation of each profile.

Besides offering a traditional trading account to exchange currency pairs, FBS offers cent accounts for those who want to gain experience while risking smaller amounts.

You can also create a demo account to practice via a simulation. A demo account can be a good way to gain some experience without taking risks and familiarize yourself with the FBS trading platform.

FBS stands out by offering Islamic trading accounts. These accounts allow investors to exchange currency pairs without swaps or interests, which go against the Islamic faith. It’s an inclusive option that few brokers offer.

When you open a new account with FBS, a customer service representative will give you a call and ask a few questions to better understand your goals and experience. You will then get a personalized recommendation for the type of account that makes the most sense for you.

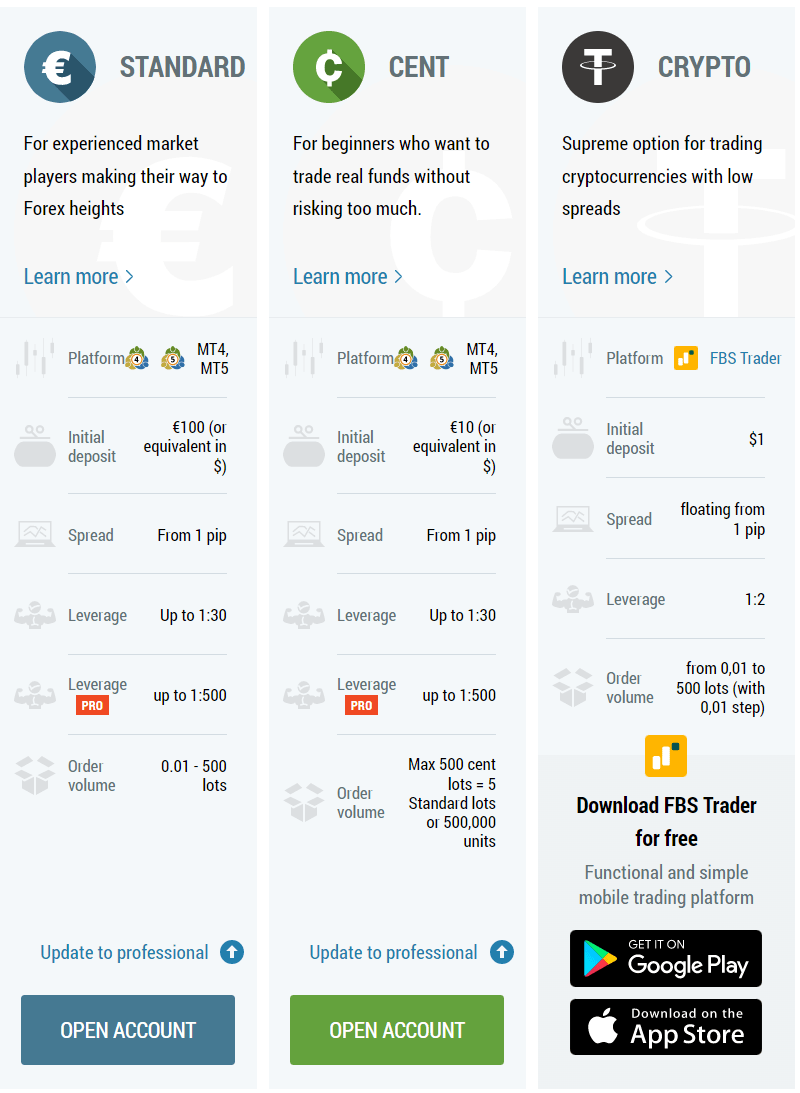

Initial Deposits

FBS is an accessible option for new investors thanks to low initial deposits. You can open a standard trading account with as little as 100€ or around $108. If you want a cent trading account, you’ll need to deposit 10€ or around $11.

You can start trading cryptocurrencies with only 1€ or around $1.

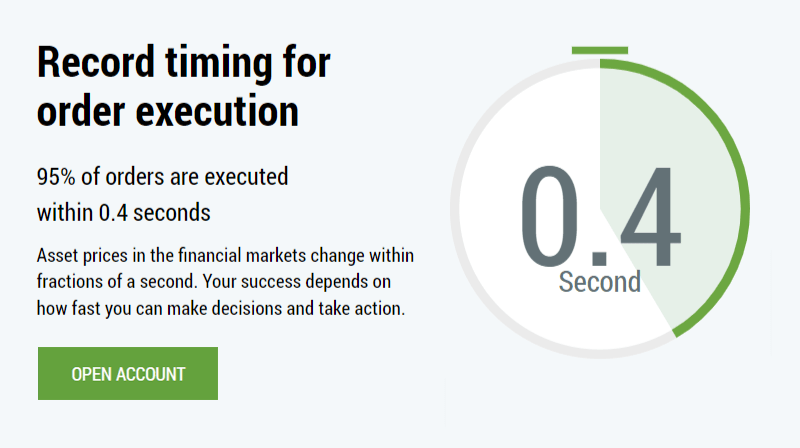

Market Execution Time

The market execution time of a broker matters because prices can change quickly, especially with volatile currency pairs or cryptocurrencies.

Professional trading platforms can process trades in as little as 10 milliseconds. FBS has a market execution time of 300 milliseconds.

It’s slower than what professional traders have access to, but 300 milliseconds is a respectable market execution time when compared to products designed for retail investors.

Leverage

With leverage, you can borrow from FBS to maximize your investment and potentially earn more. Note that leverage is for advanced investors who have a sound strategy to pay the money back in case the trade doesn’t work in their favor.

FBS offers two levels of leverage. Standard investors have access to a leverage ratio of 1:30 for Forex trades and 1:3 for cryptocurrency.

If you’re a professional investor, you’ll get access to a 1:500 leverage ratio in the Forex market and 1:5 for cryptocurrency trades.

US-based brokers have to follow regulations that limit leverage to 1:50 for Forex trades. The professional leverage limit offered by FBS can be hard to find, but the standard ratio aligns with what most brokers are willing to offer.

Some brokers offer higher leverage ratios for cryptocurrency trading. However, putting a limit on the amount of leverage you can use is a smart strategy for mitigating your risks in this volatile market.

Spread Points

When engaging in speculative trading activities like Forex trading, it’s important to consider a broker’s spread.

The spread is the difference between the ask and bid price. Brokers execute orders at a slightly higher price to generate a profit, but the spread can also vary because it takes a few seconds to place an order and the price can change.

Brokers offer spreads that range from one to five pips. FBS offers spreads that rarely exceed one pip, which is a major reason to consider using this broker, especially if you engage in high volumes of short trades.

Trading Platform

FBS has two versions of its trading platform, MetaTrader 4 and MetaTrader 5 compatible with newer devices.

You can download a desktop version for Windows or Mac, or use an app on Android or iOS. Being able to trade on different devices is a plus, and using software and apps instead of a web-based platform opens up more possibilities.

For instance, you can access advanced analytics tools, benefit from an encrypted connection, or use scripts to automate your trades.

There is a slight learning curve to familiarize yourself with the trading interface, but overall the platform feels accessible, functional, and intuitive.

Deposits and Withdrawals

Deposits and withdrawals are another area where FBS shines. You can transfer money via Mastercard, VISA, Skrill, Neteller, or initiate a wire transfer.

There are no deposit or withdrawal fees as long as you used the funds for trading. All deposit and withdrawal requests are instant, except wire transfers which take a few days to process.

Educational Resources

FBS stands out by offering quality educational resources created by industry experts. Beginners can learn a lot by attending webinars or watching videos. These resources will help you learn more about financial markets, but you’ll also learn how to execute trades.

FBS also published articles regularly to discuss Forex news and market trends. You’ll also find detailed analyses that go beyond Forex and discuss stocks, cryptocurrencies, and the CFD market.

The educational resources add value, but the focus is on Forex trading. There are other publishers with better resources for keeping up with stocks and the crypto market.

Commissions and Costs

Compared to other brokers, FBS charges reasonable fees for using its trading platform. You can open an account for free and get started as soon as you make your initial minimum deposit.

Deposits and withdrawals are free as long as you used the funds for trading. If you want to withdraw money without placing a trade, you will pay a 5% fee.

FBS trades a trading fee for each transaction. The spread covers this fee, which can vary based on the trade and time of day. Typically, you should expect to see spreads of around one pip to cover this fee when trading Forex currency pairs.

Fees are higher in the CFD market. The transaction fee varies a lot from one product to another and can range from 0.2 points to more than 3 points.

Overall, these transaction fees align with what other brokers offer. However, FBS stands out by offering lower leverage fees.

The financing rate can be as low as 1.5% and can go all the way to 2.5%. FBS will adjust the financing rate based on the product you want to leverage and how much you need to borrow.

Customer Support

FBS has a main office in Cyprus. There is a time difference, but the support team is available 24/7.

You can fill out an online form to request a callback, or contact the support team via phone, email, or social media.

Customer service representatives are knowledgeable and always do their best to help customers based on the many positive online reviews that mention interactions with the support team.

Licenses and Regulations

FBS has a license to operate in Europe issued by the Cyprus Securities and Exchange Commission. This organization complies with broader European regulations like the Markets in Financial Instruments Directive of 2014 and has been taking steps to improve transparency among brokers.

This CySEC license is a sign that FBS has to follow strict guidelines when it comes to managing funds, sharing disclosures, and making claims.

However, if you’re in the US, you’ll be able to create an account with a branch of the FBS brand that operates with an IFSC license through an offshore registration model. The IFSC is an agency located in Belize.

The IFSC can be lenient compared to the financial rules and regulations that apply to US-based companies. One of the advantages is that FBS can offer higher leverage levels, but the broker doesn’t have to follow strict requirements when it comes to disclosures or auditing.

It’s not a major issue since FBS has been around for a while and has proven to be a trustworthy broker.

Conclusion

FBS is a great option for anyone interested in alternative investments, including Forex, cryptocurrencies, or CFDs. With over a decade of experience, FBS is a trusted broker, and the lower-than-average fees are a plus. We also like the fact that you can create different types of accounts and gain some experience with a demo or cent account.