Table of contents

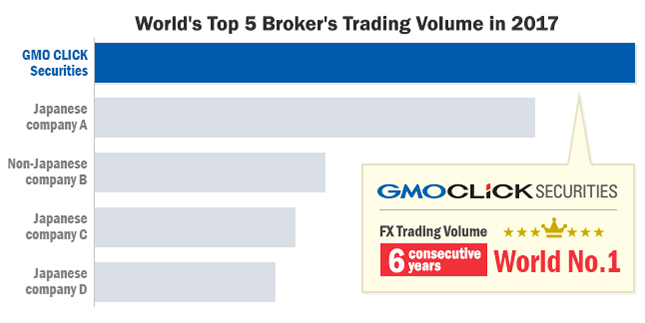

If you were to put together Z.com Trade with its sibling companies around the world, including GMO Click Securities, by total volume the entire family has been the largest retail forex trading firm in the world for six years running. As a result of the size of this firm’s trade volume, clients will surely witness certain benefits, most notably their large liquidity pool and their ability to provide very tight spreads.

With offices in London, Hong Kong, and Tokyo, as well as over 400,000 worldwide clients, the GMO Click Group also keeps its clients happy by not only providing high quality, comprehensive trading services, but also providing in-house technical support, and some of the tightest spreads available in the industry.

Below we’ll take a closer look at how Z.com Trade compares to other online brokers to help give you a sense of what to expect when dealing with this massive firm.

Available Products

Z.com Trade gives traders access to a surprisingly small number of financial instruments. Traders with Z.com Trade have access to major forex pairs, spot metals, indices, commodities, and oil.

Z.com Trade’s emphasis, though, is on giving traders access to forex pairs, which are trades between various foreign currencies. These make up the largest financial market in the world.

Types of Accounts

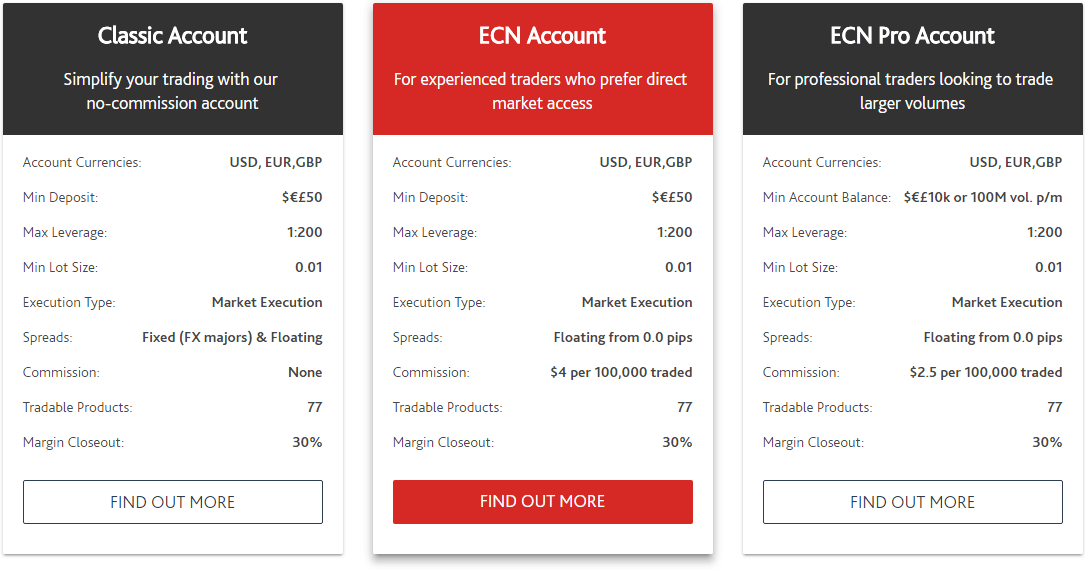

There are three types of accounts available with Z.com’s all of which are available in either GBP, USD or Euros.

Classic Account

The Classic Account is designed for clients who prefer trading on a no-commission basis. The spread is the only cost for traders, and is quite low, with fixed spreads starting at 1.5 pips for all major forex pairs.

Available in either GBP, USD, or Euros, the minimum deposit is 50 currency units, with maximum leverage of 1:200. With a classic account, traders get access to 24 forex pairs, five commodities, and eight indices.

ECN Account

For more experienced traders, the ECN account provides direct market access, with spreads as low as 0.0 pips. The ECN account gives traders access to 59 forex pairs, seven commodities, and 11 indices. With an ECN account, the commission is equal to $4 for 100,000 traded in forex, gold, and silver, with no commission for other indices and commodities.

ECN Pro Account

For professional traders who will be trading larger volumes, the ECN pro account provides cost savings as well as more personalized service. Once an ECN account has reached 10,000 (GBP/EUR/USD), traders are available for upgrade to pro status. Spreads are floating from 0.0 pips, with commission dropping to $2.50 per 100,000 traded (for forex, gold, and silver) and no commission for other commodities and indices.

Platforms

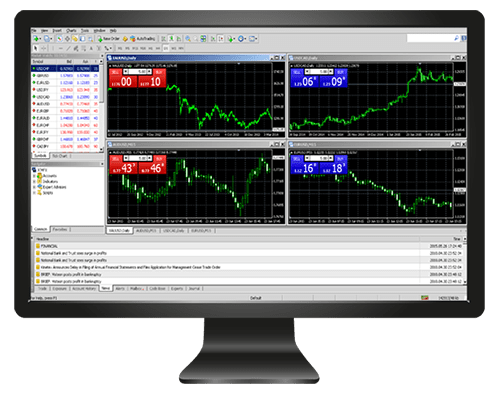

Another benefit of Z.com Trade’s size is the ability to develop and support their software in-house. This means that they are constantly improving their platform, and will be able to handle any bugs and fixes that users might need. Z.com Trade features four different types of account platforms: the MT200, the MT400, the Auton200, and the AutonBinaryOption.

As the name suggests, the MT200 has maximum leverage of 1:200 and is Z.com’s standard account, featuring fixed spreads and a maximum of 40 individual positions.

The MT400 is ideal for more advanced traders, with a maximum leverage of 1:400, as well as fixed spreads and a maximum 40 individual positions.

For those interested in algorithmic trading, there is a new platform experience available with the Auton200. The Auton200 has a maximum of 100,000 lots for all combined symbols available.

If you’re interested in binary options, the AutonBinaryOption account can yield up to 80% return with a minimum investment of 5 USD and a maximum investment of 500 USD.

Trades are only available through these platforms, and never by phone nor any other method.

Regulation

GMO Click Securities are regulated by a number of regulatory bodies around the world: in Japan by the Japan Financial Services Agency (FSA), in the UK by the Financial Conduct Authority (FCA), and in Hong Kong by the Hong Kong Securities and Futures Commission.

In the UK, Z.com Trade is regulated by the FCA, which makes it a participant in the Financial Service Compensation Scheme (FSCS). This ensures that all accounts are protected up to 50,000 GBP in case of a major financial incident. Under FCA regulations, Z.com Trade is also obliged to hold tangible assets which amount to at least 730,000 GBP to ensure financial stability.

In addition, all accounts are segregated, meaning that neither Z.com, GMO Click Securities, nor any of their creditors ever have access to clients’ funds. These client accounts are reconciled daily and are held in top-tier banks.

Desktop Experience

Although their flagship proprietary trading platform, Z.com Trader performs well, traders who are already familiar with MetaTrader4 will be happy to know that the site also offers their entire set of services through the MetaTrader 4 platform. For traders who prefer automated or algorithmic trading, Auton is also available on Z.com Trade.

If you’ve never used MetaTrader 4, it is the industry standard for online trading. MT4 is fully customizable, features advanced charting tools, technical indicators and expert advisors, and is available in over 30 languages. With MT4, traders can create their own algorithms, backtest them for success rates, and automate trades.

For traders interested in algorithmic trading, Auton features advanced charting and technical analyses and is ideal for multiple asset trading. Users can employ existing trade strategies or create their own algorithms.

Auton also offers built-in analysis tools including Moving Average, Fast/Slow Stochastic, Price Oscillator, and Bollinger Bands. Chart styles include parallel line, parabola, and projection line.

Mobile Experience

Both MT4 and Auton platforms for Z.com are available for iOS and Android mobile devices. These platforms will naturally lose some of the sophistication of the desktop versions, but traders will be able to engage in “one-click” trading.

Payment Options

Compared with most other online trading platforms, Z.com has quite a large range of funding options. Like most online brokers, deposits can be made by credit/debit card, bank wire transfer, but there are also a number of e-wallets which are accepted, including Boleto, Giro, Ideal, Skrill, Trustly and others.

Instruments Available

Depending on the account, clients will have access to a broad range of 59 currency pairs (with up to 200:1 leverage available), as well as seven commodities and 11 indices.

Partnership Opportunities

There are several ways that investors, especially on an institutional level, can take advantage of partnership with Z.com to help increase their earnings.

Introducing Broker

For clients who refer other clients to Z.com, there is a significant commission, based on each referred client’s trading volume.

Prime of Prime

For institutional clients, Z.com offers prime of prime service, which gives them access to he worlds’ largest liquidity pool, the Japanese FX market.

Affiliates

For businesses with websites, a new revenue stream is available by directing trade traffic to Z.com and earning a healthy commission.

Z.com Prices

The minimum deposit for opening and maintaining an account with Z.com Trade is 50 (GBP, USD, EUR), which is quite low within the industry.

Z.com Trade’s spreads range from 0.5 pips for USD/JPY to 0.6 pips for EUR/USD, with leverage available up to 200:1. For CFDs on commodities and indices, leverage and trading costs will depend on the instrument.

Criticism Of Z.com Trade

The UK version relies on Adobe Flash, which some users will find prohibitive and problematic.

The UK version relies on Adobe Flash, which some users will find prohibitive and problematic.

Crypto-currencies, which have recently become a hugely popular trading instrument, are only available in Japan. We also found that the Classic Account was slightly weak, as it features less forex pairs available and a small maximum trade size. There is a wider range of markets available for the other accounts.

Customer Support

With a firm this size, Z.com’s customer service represents are used handling a high volume of service calls, and we found them to be responsive, as well as extremely knowledgeable and courteous. Customer Support is available via phone or live chat during business hours (9am-5pm UK time, Monday through Friday).

Whether you are a beginning or experienced trader, there is a good number of support materials available, including guides to using their platform, information regarding fundamental and technical analysis, pricing streams, advanced charting tools, a market calendar, and news feeds.

With over 400,000 clients worldwide, there must be a reason that Z.com Trade is doing the high volume of business that it is. Despite its large size, and unlike many other online brokers, Z.com Trade has chosen to focus on a smaller number of financial products, chiefly forex, commodities, and indices. Traders who are interested in diversifying across a larger number of products may choose to take their business elsewhere.

The main benefit of dealing with Z.com’s size is their liquidity pool, making for consistent capital adequacy. This high amount of liquidity makes it possible for traders to engage in high volume trading, but traders will also see the benefits of Z.com’s size in their ability to offer tight spreads, fixed and variable pricing systems, and sufficient regulations to provide security.